VIRTUAL PAYMENT TERMINALS CODE

This should not be a major concern when using the terminals.

VIRTUAL PAYMENT TERMINALS MANUAL

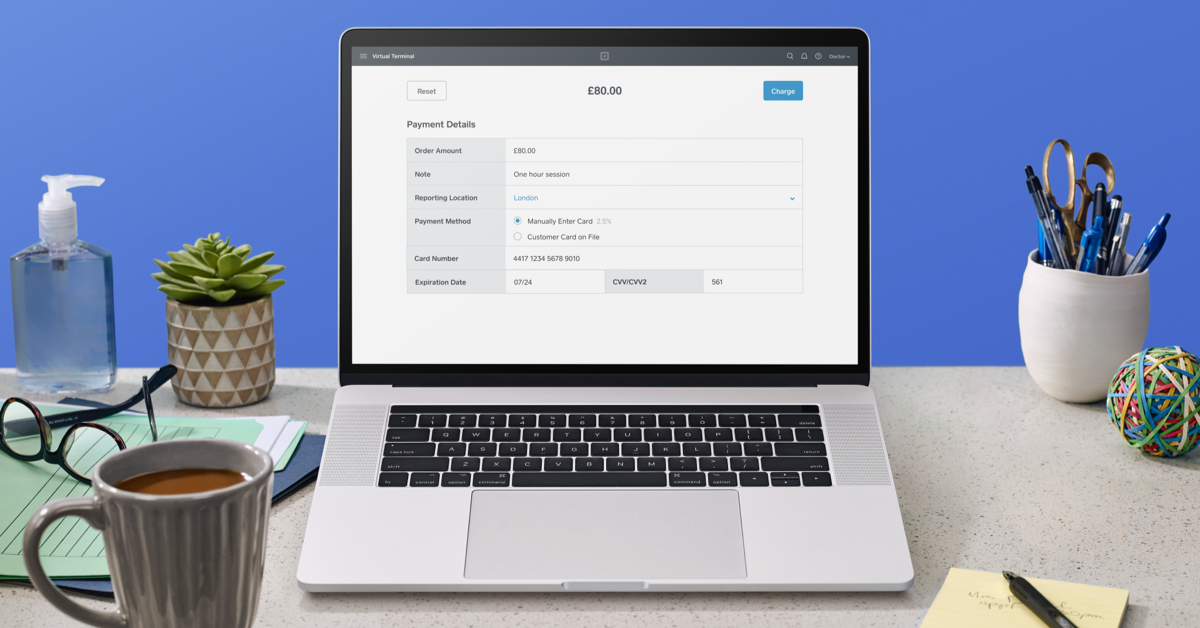

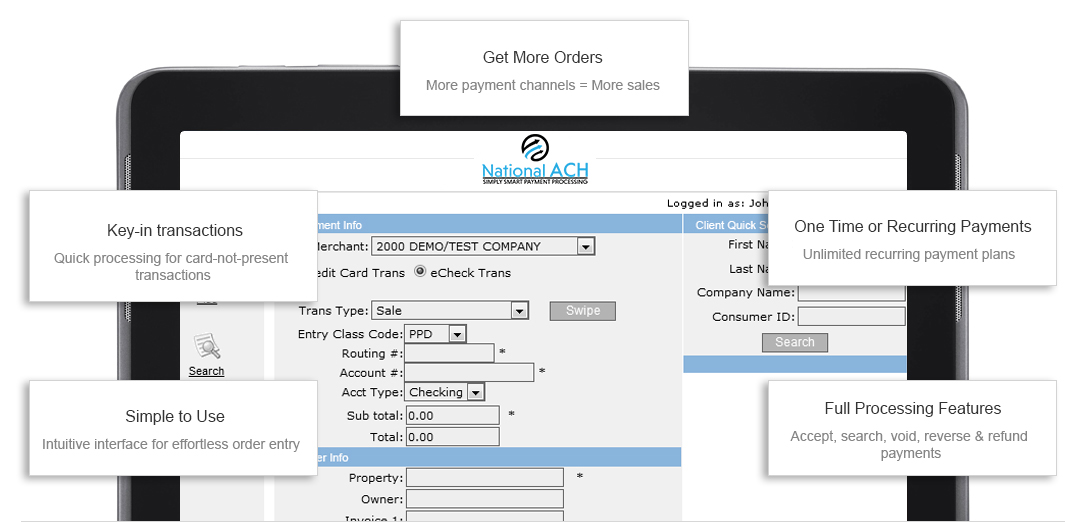

Their manual nature makes them more susceptible to errors. Granted, with these terminals, keyed-in transactions are more common. For swiped transactions, you swipe the credit card to process the customer’s payment. For keyed-in transactions, you enter the credit card details yourself. So, processing later payments is much easier in future.Īdditionally, they can handle both keyed-in and swiped transactions. That is because the computer keeps such data on file. For this reason, such customers can avoid extra costs in future. The terminals can remember credit card details of the customers. So, using these terminals ensures superior customer service is available through your business. This process is also much faster when using these terminals. The terminals offer secure processing of credit card information. This should not be a challenge because you are using the computer as a terminal. Reliable Virtual Terminal ProtocolsĪ good terminal should keep client information secure at all times. Besides, getting real-time analysis on how the payments are going is pretty straightforward. It does not matter how many terminals there are. Reliable network virtual terminal services make payment monitoring easy. All they need is computer with the same software.

Employees from around the world can use the same terminal to accept and process payments. This is what makes this payment processing mode international.

You can even use your phone, and tablet as well. Then you can roll it out to other locations where your business operates. First of all, you set up a terminal on your computer. One of the major benefits of a virtual payment terminal is that it makes remote billing very easy. This is something more customers would like when making credit card payment solutions. With these terminals you can run your business right from your computer. Payment confirmations happen in an instant. You will also know when a payment occurs. Such receipts are also customized to each customer. Receipts are also sent to customers in real time. That is because they process payments fast. Virtual Terminals for Credit Card ProcessingĪ virtual terminal is ideal for international credit card processing. Here are some benefits to using this virtual terminal for credit card processing. This system offers a wide range of benefits to the users. Sage virtual terminals offers a rich virtual terminal credit card processing environment. The only other thing that is necessary is a software. That is because the computer itself acts as the terminal.

Additionally, no extra costs are necessary to set up these terminals. That is because no new devices are necessary. There are few barriers to users of this payment processing method as well. Virtual Terminal for Credit Card International ProcessingĪ virtual terminal for credit card processing makes payment processing easier.

0 kommentar(er)

0 kommentar(er)